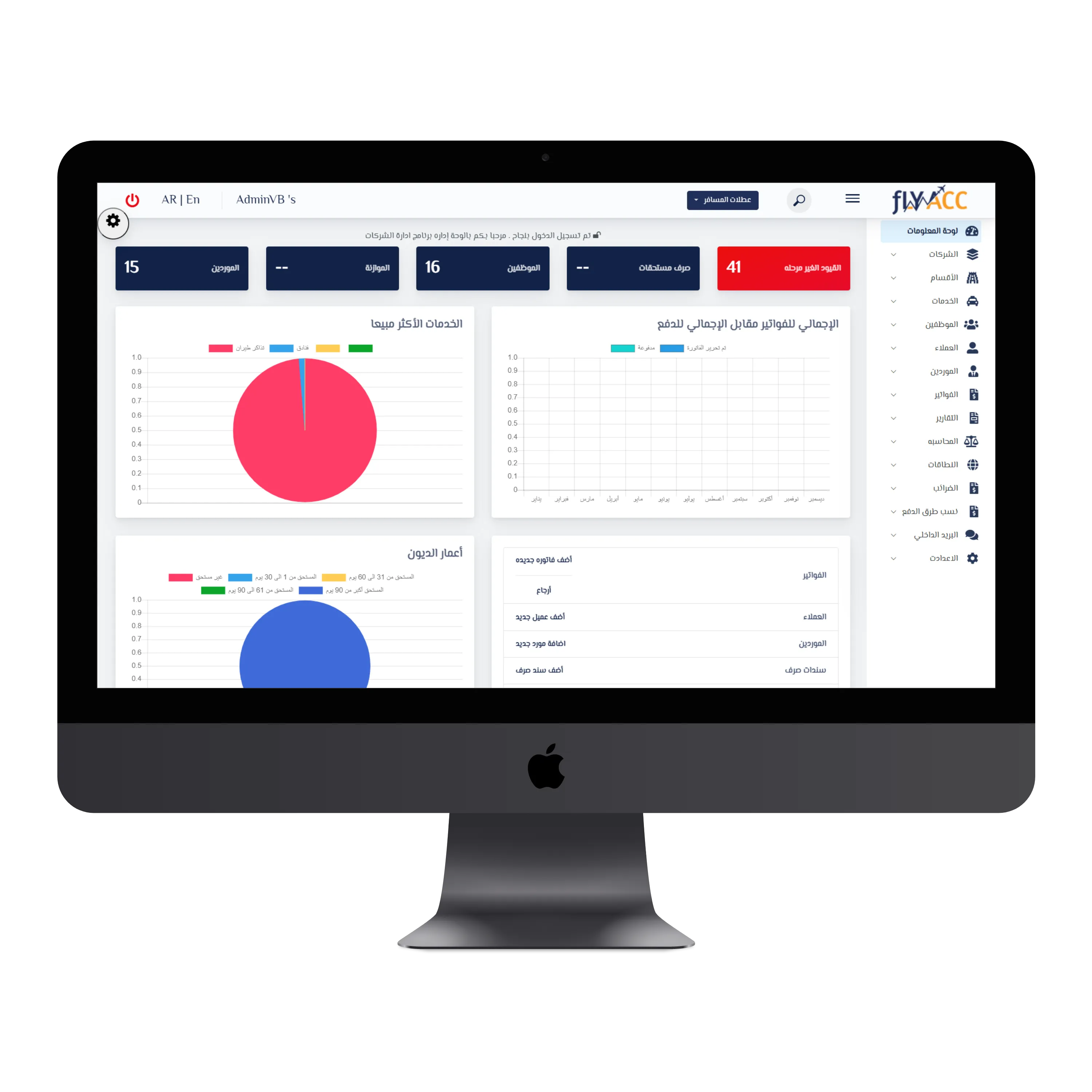

Corporate account management software

Corporate Accounts Management Software is an accounting program that enables you to manage public accounts accurately with advanced tools and features in an easy-to-use interface that supports Arabic and foreign languages. Accounting program You do not need to possess deep knowledge in the field of general accounts, as daily entries are recorded automatically for each transaction that takes place on your account, or you can enter them manually with multiple options, and it also provides you with a tree-organized accounting guide with a professional presentation of the sub-accounts with all the necessary details, to In addition to professional management of the cost centers in your company with a professional tree organization, controlling annual entries movements with ease, with accurate management of your financial transactions such as receipt or exchange vouchers and tracking them, whether in the company’s treasuries or bank accounts, in addition to detailed financial reports such as tax reports and final lists, in order to help you in Calculating profit and loss ratios and making the necessary decisions to achieve your business goals.