The revenues of travel and tourism companies vary according to the size of the tourism company, for example, tourism companies category (C) whose revenues are represented in the commissions resulting from the difference between the revenue of service sales and the cost of the service, while the revenues of the large-sized travel and tourism company, category (A), vary as follows:

1- Hotel reservations commission resulting from the difference between the hotel reservation revenues and the reservation cost.

2- Commission of airline tickets reservations for the difference between airline ticket revenues and the cost of the reservation.

3- Revenues from internal and external tourism trips (archaeological tourism - religious tourism - performing Hajj and Umrah - domestic tourism - entertainment tours - car rent - bus revenues - other revenues ...).

The tourism company shall issue invoices of its dues attached to it with forms known as operating orders (which are a form showing the data of the operation process) indicating the following data:

(Driver's name - operating hours - operating date - operating order number - number of tourists - customer name - name of the supervisor / tour guide - vehicle data - .....) Then special operating orders are collected for each destination separately (a specific hotel - a restaurant A specific - a specific Nile cruise - ....) and an invoice is issued with the total value of the operating orders indicating the same data of the operating order in addition to it (name of the party to which the invoice is addressed - the amount of the invoice - the value of VAT - the payment period ....) Collecting the value of this invoice in cash as soon as the operation order is completed or a deadline is obtained according to the agreement with the party from which the bills are to be collected. All operating orders are recorded monthly in the so-called "movement book" that differs from the assistant professor of revenue that contains an analysis of the types of revenues of the tourism company and the value of each The revenue and percentage of each activity from the total revenue of the company.

As for the expenses of travel and tourism companies, they vary between activity costs and general and administrative expenses.

A - Activity costs, including:

IATA -1 costs for airline tickets booked that are payable through the website

2- Hotel reservation costs, which are reimbursed to hotel agents.

3- Tourism trip costs (religious - archaeological - entertainment - internal - Hajj and Umrah ...)

4- The costs of the various means of tourist transport (buses - cars - trucks - .....) of drivers' wages, fuel, oils, spare parts, license fees, transit fees, and others.

5- Wages and salaries of supervisors, tour guides, and tour group escorts.

6- Commissions for marketing agents and brokers for tourism companies.

7- Costs of meals, clothes, and benefits in kind for employees or tourist groups.

B - General and administrative expenses

They are the expenses related to the salaries of the administration employees and the administrative and financial apparatus of the company, as well as the rent of the company's headquarters, warehouses, expenses of water, electricity, stationery, paper and printing inks, advertising expenses, marketing expenses, annual subscriptions to the website and others.

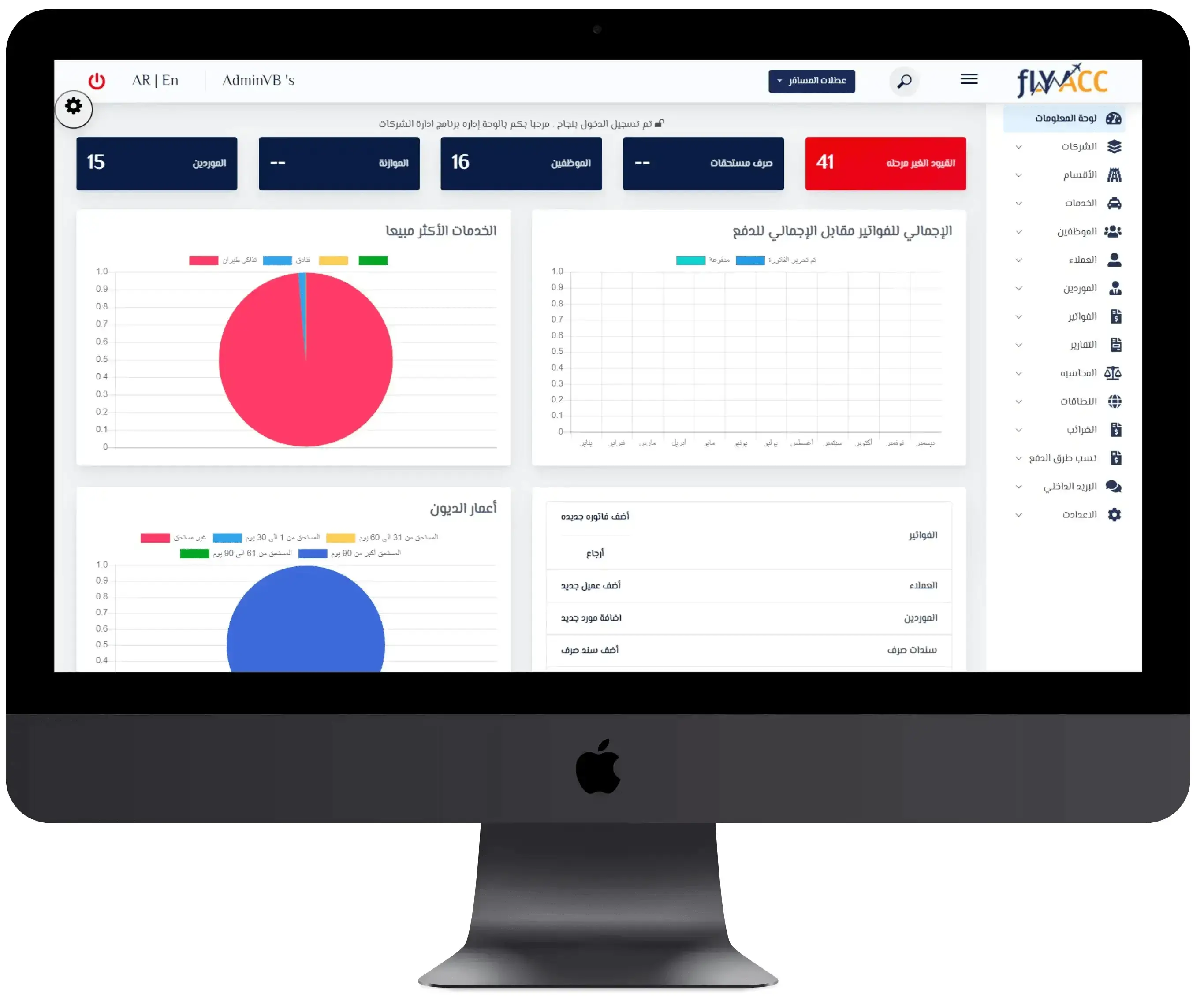

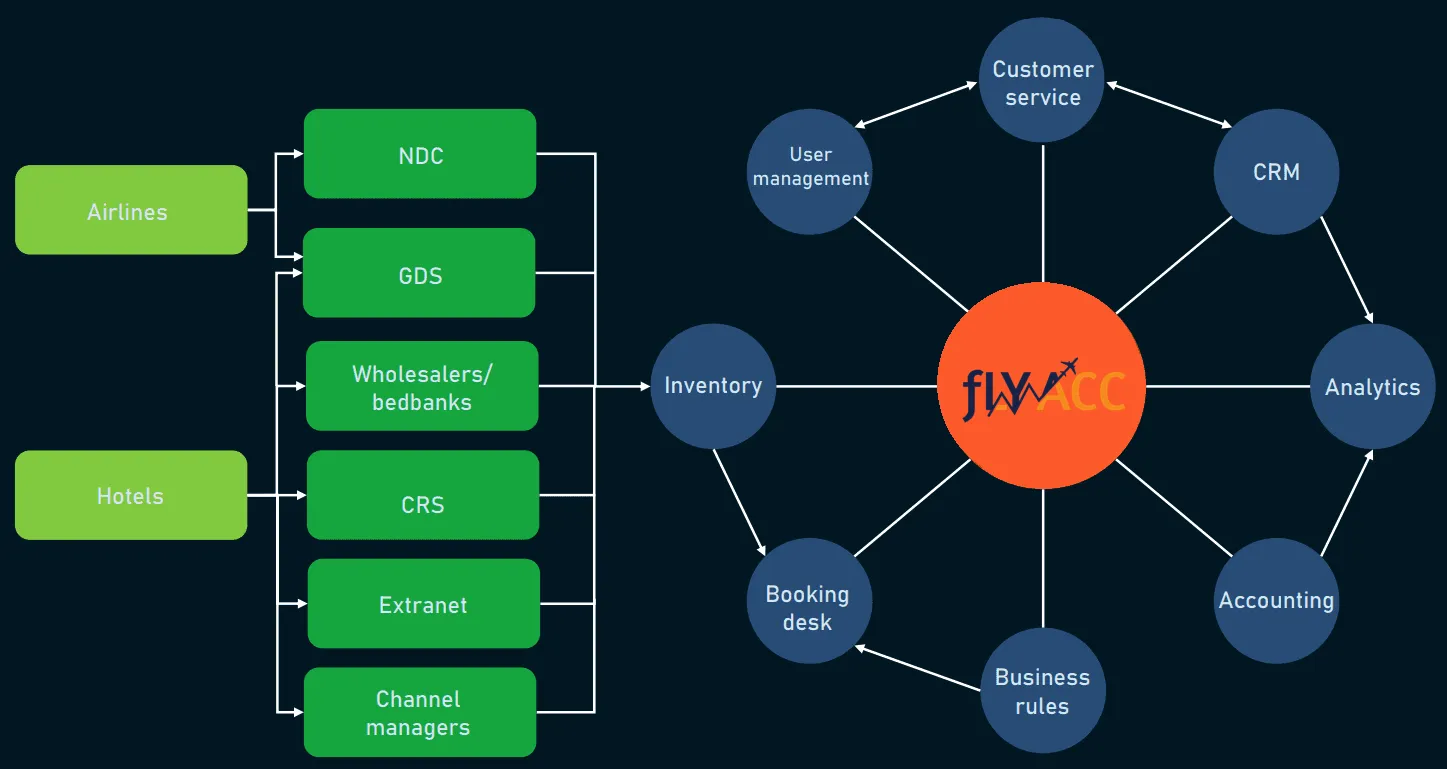

All revenues and expenditures of travel and tourism companies are recorded and classified in the chart of accounts in order to obtain accounting reports that show the value of the profits or losses of the company during the financial year, and to know how to record and classify the revenues and expenditures, it is necessary to first know the tree of accounts for the travel and tourism company.

Travel and tourism company account tree